The first step of our coworking is a meeting, where our clients tell about their problems and needs. From our side, we tell how we can help you.

what we do

Here you can learn more about each service we provide, and select which one fits you. After you selected the service, feel free to contact us for further details.

OUR SERVICES

Here you can learn more about each service we provide, and select which one fits you. After you selected the service, feel free to contact us for further details.

LABUAN COMPANY

What is Labuan Company?

- Labuan Company (“LC”) is a company incorporated or registered under Labuan Companies Act 1990.

- May be a company limited by shares or by guarantee or an unlimited company.

- Able to participate in business activities

- Would need to be licensed if it intends to undertake businesses as defined under the Labuan Financial Services and Securities Act 2010 & Labuan Islamic Financial Services and Securities Act 2010.

- Can own controlling stakes in a Malaysian domestic company

- Residents and non-residents of Malaysia are permitted to establish a LC

- 100% foreign ownership allowed

Characteristics:

- Shall have at least have one resident director and one resident secretary.

- No minimum capital and no authorised share capital requirements

- The shares issued shall have no par or nominal value

- Shall have a registered office in Labuan which is the office of the resident secretary.

- Incorporation within 24 hours*

- No bearer shares are allowed.

- Accepted for listing at key international exchanges including:

- National Stock Exchange of Australia

- Hong Kong Stock Exchange

- Singapore Exchange

- NASDAQ Dubai

*Fast track application. The turn around time is upon the approval from Labuan FSA.

LABUAN FOUNDATION

What is Labuan Foundation?

- A Labuan Foundation (“LF” is based on civil law structure and can be described as hybrid of a trust and corporation. It is tailor-made for high net worth individuals (HNWI), families as well as corporations and non-profit organisations who wish to have control over their assets and businesses whilst being accorded legal protection.

- Establishment of LF for any lawful purpose which may be charitable or non-charitable.

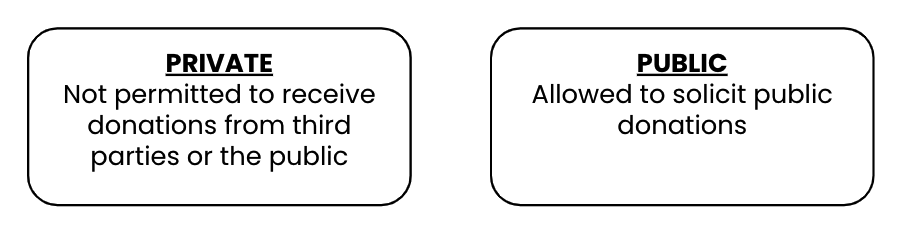

Characteristics of Non-Charitable LF (Conventional or Islamic):

- Endowment of properties can only be done by the founder and the person to whom he had assigned or transferred his rights, powers and obligations under the Labuan Foundations Act 2010 (referred to as “the assignee”). In this regard, a non-charitable foundation is not permitted to receive donations from third parties or the public.

Characteristics of Charitable Labuan Foundation (Conventional or Islamic):

Charitable purpose means and includes any of the following description of purposes:

- The prevention and relief of poverty

- The advancement of religion, profession, or education

- The advancement of health including the prevention and relief of sickness, disease, or of human suffering

- Social and community advancement including the care, support and protection of the aged, people with a disability, children, and young people

- The advancement of culture, arts, and heritage

- The advancement of amateur sport, which promotes health by involving physical or mental exertion

- The promotion of human rights, conflict resolution, and reconciliation

- The advancement of environmental protection and improvement

- The advancement of animal welfare

- The advancement of facilities for recreation or other leisure-time occupation in the interest of social welfare

LABUAN TRUST

What is Labuan Trust?

A Labuan trust is a highly effective vehicle for asset preservation, protection and income distribution, making it one of the primary vehicles used to pass wealth from one generation to the next. It provides unparalleled financial control with exceptional fiscal advantages.

The creation of a Labuan trust is generally for an individual or a settlor to give specific property to a third party to be held for the benefit of others, including charities. The Labuan Trust Act 1996 allows the creation of the following types of trust:

- Purpose trusts;

- Charitable trusts;

- Spendthrift or protective trusts; and

- Labuan special trusts.

What is The Purpose of a Labuan Trust?

A Labuan Trust may be created or established for a specific particular purpose which could be charitable or otherwise. A charitable purpose means and includes any of the following description of purposes:

- The relief or eradication of poverty;

- The advancement of education;

- The promotion of art, science and religion;

- The protection of the environment;

- The advancement of human rights and fundamental freedom; or

- Any other purposes which are beneficial to the community

Who Can Setup A Labuan Trust?

A resident or non-resident can do so. In the case of a non-resident, Malaysian property can be injected into a Labuan Trust while a Malaysian resident can place international assets into a Labuan Trust but Malaysian property requires the approval of the regulator, Labuan FSA.

Partnership

Labuan IBFC offers a range of tax benefits and a conducive regulatory environment that facilitates the formation of partnerships. The jurisdiction’s favourable geographical position in Asia Pacific promotes the likelihood of cross-country cooperation and connects investors to other emerging economies in the region.

There are two types of partnerships in Labuan IBFC, namely limited partnerships and limited liability partnerships.

- Labuan Limited Partnership – Limited partnerships in Labuan IBFC enjoy the many business opportunities and commercial prospects offered in the jurisdiction.

- Labuan Limited Liability Partnership – A limited liability partnership is an alternative business structure that combines the features of a limited liability entity with those of a partnership.

Labuan Leasing

The leasing industry in Labuan IBFC has recorded tremendous growth in recent years. In tandem with the region’s economic growth, demand for capital equipment, especially in the shipping, aviation, and oil and gas industries, have shown no signs of abating. Its innovative leasing structures and close proximity to emerging economies such as China and India attract both local and foreign corporations, opening up a variety of investment opportunities in the region.

Leasing companies in Labuan IBFC enjoy an ideal balance of fiscal neutrality and certainty. The ease through which leasing transactions can be structured in the jurisdiction, along with an efficient tax framework, have also allowed for effective management of their operational cost.

A normal leasing transaction includes earning rental income for the lessor, and the lessee benefiting from the leased asset, for example in providing short-term capital and facilitating business operations.

Labuan Banking

As much as half of the world’s capital is estimated to flow through international business and financial centres, making banking the most important activity in these centres.

Labuan IBFC offers a wholesale platform for banks and financial intermediaries looking to establish their operations and take advantage of the numerous associated opportunities in the region. Labuan IBFC is also bound by an effective regulatory regime that subscribes to internationally-recognised standards and best practices in financial services and prudential regulation.

Labuan banks and investment banks operating out of Labuan IBFC provide a host of services, conventional as well as Islamic to cater to the growing demand from investors both domestic and international.

Labuan Insurance

Labuan IBFC’s insurance industry is a thriving one, as evidenced by its vibrant growth in the past few years. Comprising not just reinsurers and direct insurers, Labuan IBFC also provides unique underwriting vehicles in the form of captives. This is an increasingly popular risk solution sought by many corporates that prefer to have the flexibility of managing their own perils as part of their own risk management. Aside from conventional (re)insurance services, Labuan IBFC also offers Islamic (re)insurance, better known as (re)takaful, for those seeking Shariah-compliant protection. Insurance brokers, underwriting managers as well as insurance managers complete the supply chain by offering the needed services within the sector.

The industry is set on a positive trajectory and will continue to expand to provide the needed reinsurance capacity and insurance products in order to meet sophisticated clientele needs and expectations. Business flexibilities in tandem with an orderly set of regulations provide a stable business environment for prospective investors and clients alike.

Labuan Factoring

Labuan factoring is defined as the business of acquiring debts to any person or institution at a discount or such other business as approved by Labuan FSA.

Application Requirements

The submission should include the following:

- The nature of business of the applicant

- The composition of its board of directors and senior management (prior written approval from Labuan FSA must be obtained for any appointment of director, controller or chief executive officer, who must be fit and proper persons).

- A business plan detailing the operations and strategies of the applicant.

- Audited financial statements for the last two years, if applicable; and

- Any other information that may be relevant to the application.

Operational Requirements

The applicant company:

- has an option to either set up an office in Labuan or operate through its registered office. However all transactions must be done through Labuan and adequate and proper records and books of accounts must be maintained in Labuan

- must maintain capital sufficient to manage the company’s daily operations

- must transact business only in foreign currency and not deal in Malaysian Ringgit except for the purpose of defraying administrative and statutory expenses

- is prohibited from dealing with Malaysian residents other than those approved by Bank Negara Malaysia

- must conduct its business with due diligence and sound principles and comply with the local laws and regulations where it services its clients

- is to indicate clearly its name on its letterhead, stationery and other documents

- must appoint an auditor

- is to submit to Labuan FSA within three months after the close of each financial year, one copy of its audited annual balance sheet and profit and loss account

- is to provide statistics and information as required by Labuan FSA in relation to prudential information, general business conduct and volume and direction of business in Labuan

- must notify Labuan FSA of any change to its constituent documents, shareholdings, management or business plan; and

- must comply with any other requirements issued by Labuan FSA from time to time.

Fees

All licensees are required to pay to Labuan FSA annual licence fees on or before 15 January of each year:

Annual Fee RM40,000 @ USD13,000

Governing Legislation

- Labuan Financial Services and Securities Act 2010

- Labuan Companies Act 1990

- Labuan Business Activity Tax Act 1990

Labuan Money broking

Money broking business is defined as the business of arranging transactions between a buyer and a seller in the money markets, with a broker acting as an intermediary for consideration of brokerage fees paid. However, this does not include the buying or selling of foreign currencies by the said broker as principal in such markets.

Commodity Trading

As part of the strategy to encourage oil and gas trading companies to expand into Malaysia, Labuan IBFC introduced the Global Incentives for Trading (GIFT) programme in 2011. The GIFT programme is a framework of incentives designed to attract traders of specified commodities to use Malaysia as their international or regional trading base.

Under the GIFT programme, a Labuan International Commodity Trading Company (LITC) can be set up to facilitate the trading of physical and related derivative instruments in any currency other than the Malaysian Ringgit in the following commodities: petroleum and petroleum-related products (including liquefied natural gas (LNG)), agriculture products, refined raw materials, chemicals, base minerals, carbon credits and any other commodities as may be approved by Labuan FSA. The programme’s ultimate aim is to position Malaysia as a regional trading and storage hub for oil and gas.

Credit token business

A credit token business is defined as any business where a token, being a cheque, card, voucher, stamp, booklet, coupon, form or other document or thing is given or issued to a person (referred to as “customer”) by the person carrying on the business (referred to as “issuer”), whereby such issuer undertakes that:

- on the production of the token, whether or not some other action is also required, the issuer will supply cash, goods or services on credit; or

- where, on the production of the token to a third party, whether or not any other action is also required, the third party supplies cash, goods or services, the issuer will pay the third party for them, whether or not deducting any discount or commission, in return for payment to be made thereafter to the issuer by the customer.

And for the purposes of this definition, the use of a token to operate a machine provided by the issuer or by a third party shall be regarded as the production of the token to the person providing the machine.

Company management business

Company management business means the provision of treasury processing services and such other services, and to such persons, as may be permitted by Labuan FSA. The permissible activities of company management firms are described as follows:

- Treasury processing activities comprising back and middle office processing functions which include processing and confirming deals, preparing accounting records and reports, maintaining registers and files and custodial services.

- Islamic advisory services and processing functions which include launching, administering, and backroom processing of collective investment schemes; consultancy, advisory and support services; and developing Islamic trusts.

Malaysia International Ship Registry

Labuan IBFC’s strategic location enables investors to foster long-lasting business relationships with Asia’s emerging economies such as China and India. In addition, it lies in close proximity to major shipping routes and boasts excellent shipping support services and facilities.

The Malaysian International Ship Registry (MISR), introduced to attract individual or foreign shipping companies to register their ships through Labuan IBFC thereby bypassing the requirements for a Malaysian majority shareholder, is expected to further enhance the jurisdiction’s shipping operations.

Shipping operations include the transportation of passengers or cargo by sea or the letting or charter of ships on a voyage or time charter basis.

Capital Markets

Labuan IBFC is committed to developing its capital market in line with internationally-recognised standards and best practices. To foster investors’ confidence, Labuan IBFC subscribes to the International Organisation of Securities Commissions’ (IOSCO) core principles of securities regulation.

In addition, Labuan IBFC’s legal and regulatory framework provides a sound business environment with adequate protection and stability for the industry.

The capital market industry in Labuan IBFC is further boosted by the presence of the Labuan International Financial Exchange (LFX), which was established as a cost-effective and practical alternative to existing exchanges in the region. Wholly owned by Bursa Malaysia, LFX plays a complementary role with respect to its parent company, in attracting international investors to the country.

Investors may establish mutual funds or issue securities out of Labuan IBFC as a platform to raise funding in the international market. The jurisdiction also offers fund management licence for entities that are interested to provide management, administrative and advisory services for the purposes of investment related activities.

In addition, securities licences are also available for companies that would like to deal in securities and provide securities advice and administration services for investment purposes.

Wealth Management

Labuan IBFC is now at the forefront of international wealth planning, providing investors the flexibility to choose the ideal wealth creation and wealth preservation structure, either conventional or Islamic, that best suits their needs. This is in line with the interest in wealth management solutions which has grown in tandem with Asia’s growing economy.

High-net-worth individuals and the affluent population will find a comprehensive stable of private wealth management vehicles on offer in Labuan IBFC, such as trusts and foundations. These can be structured for a wide array of wealth management needs and are especially suitable for family offices and wealth managers in facilitating dynamic wealth transfer, dynastic planning and inheritance management.

In wealth asset planning, consideration has to be given to the laws of the trust / foundation jurisdiction together with other jurisdictions on the location of the settlors, founders, beneficiaries and endowed properties.

The key considerations for choosing Labuan IBFC as the jurisdiction of choice for wealth management include the following:

- Legal foundation – comprehensive legal system, ie sufficiency of law to render legal protection, clarity of Shariah rulings and the implementation of a well-regulated framework

- Stability – the presence of a strong government in fostering political, economic and financial stability; and

- Ease of doing business – cost efficient and easy procedures in setting up entities, with the assistance professional intermediaries and authorities.